Energy Storage Insights: Tracking Industry Hotspots!

Release time:

2025-09-16

Source:

On September 8, the National Development and Reform Commission (NDRC) and the National Energy Administration jointly released the "Implementation Opinions on Promoting High-Quality Development of Energy Integration with 'Artificial Intelligence,'" which stated that by 2027, a preliminary integrated innovation system combining energy and AI will be established, laying a solid foundation for the coordinated development of computing power and electricity. Significant breakthroughs are expected in core energy technologies empowered by AI, with applications becoming increasingly widespread and deepened. By 2030, specialized AI technologies and applications in the energy sector are projected to reach globally leading levels overall.

National Policies and Important News

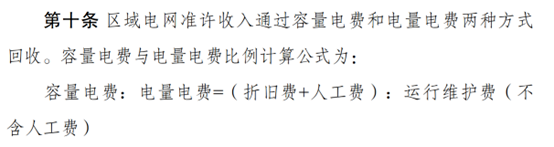

02 National Development and Reform Commission Issues New Round of Transmission and Distribution Price Consultation Draft

Local Policies and Important News

On September 8, the Qinghai Provincial Development and Reform Commission issued a public consultation draft of the "Implementation Plan for Deepening Market-Oriented Reform of New Energy Grid Connection Prices in Qinghai Province." It mentions coordinating the construction sequence of the power system, capacity demand, and the affordability of industrial and commercial users, and establishing in a timely and orderly manner market-based capacity compensation mechanisms for independent new energy storage, pumped storage, solar thermal power, hydropower, and other generating units. Effective capacity of power sources is classified according to generation characteristics: continuous adjustable power sources mainly include thermal power and adjustable hydropower (generally seasonal regulation and above); non-continuous adjustable power sources mainly include pumped storage, new energy storage, and solar thermal power; non-adjustable power sources mainly include wind power, photovoltaic, and non-adjustable hydropower (generally below seasonal regulation). New energy projects can participate in trading by reporting quantity and price or accept market-formed prices. For new energy electricity participating in cross-province and cross-region transactions, grid connection prices and trading mechanisms follow relevant policies for cross-province and cross-region power transmission, and the corresponding electricity volume is not included in the mechanism electricity volume.

Appropriately relax spot price caps, with upper and lower limits of declared prices determined by considering factors such as peak electricity prices for industrial and commercial users and other benefits new energy can obtain outside the electricity market.

It is not allowed to make energy storage configuration a prerequisite for new energy project approval, grid connection, or grid access.

Mechanism electricity volume for existing projects: electricity volumes for poverty alleviation, franchise rights, "Golden Sun" projects, distributed photovoltaics, decentralized wind power, and solar thermal power are fully included in the mechanism electricity volume. Photovoltaic "leader" projects are included in the mechanism electricity volume based on an annual power generation utilization of 1,500 hours. Grid parity photovoltaic projects commissioned after January 1, 2021, are allocated 3.6 billion kWh of mechanism electricity volume proportionally according to installed capacity; grid parity wind power projects are allocated 510 million kWh of mechanism electricity volume proportionally according to installed capacity.

Mechanism electricity price: The mechanism electricity price levels for poverty alleviation, franchise rights, photovoltaic application "leaders", distributed wind power, and parity projects are implemented according to Qinghai Province's new energy subsidy benchmark price of 0.2277 yuan/kWh; the "Golden Sun" project is implemented according to Qinghai Province's desulfurized coal-fired unit benchmark electricity price of 0.3127 yuan/kWh; distributed photovoltaic and solar thermal projects are implemented according to current price policies.

Incremental project bidding electricity price: The bidding upper limit is determined based on factors such as reasonable cost and revenue of similar power sources, green value, power market supply and demand situation, and user affordability. To avoid disorderly competition initially, a bidding lower limit is set, specifically referring to the generation cost of similar power sources and the need to support new energy development. The bidding upper and lower limits are published in the annual bidding notice.

Declaration upper limit: The declaration upper limit for mechanism electricity volume of a single centralized project = installed capacity (AC side) × annual utilization hours of the power source type × (1 - plant self-use rate) × upper limit ratio.

Declaration upper limit for distributed (decentralized) project mechanism electricity volume = installed capacity (AC side) × (1 - proportion of annual self-generated self-used electricity to generated electricity) × annual utilization hours of the power source type × upper limit ratio.

02 Hebei Provincial Development and Reform Commission issued the draft for comments of "Implementation Plan for Deepening Market-oriented Reform of New Energy Grid-connected Electricity Price in Southern Hebei Power Grid", "Implementation Plan for Deepening Market-oriented Reform of New Energy Grid-connected Electricity Price in Northern Hebei Power Grid", and "Work Plan for Bidding of Incremental New Energy Projects in Hebei Province's Deepening Market-oriented Reform of New Energy Grid-connected Electricity Price".

On September 8, the Hebei Provincial Development and Reform Commission issued the draft for comments of "Implementation Plan for Deepening Market-oriented Reform of New Energy Grid-connected Electricity Price in Southern Hebei Power Grid", "Implementation Plan for Deepening Market-oriented Reform of New Energy Grid-connected Electricity Price in Northern Hebei Power Grid", and "Work Plan for Bidding of Incremental New Energy Projects in Hebei Province's Deepening Market-oriented Reform of New Energy Grid-connected Electricity Price".

The document points out that for stock projects, combined with the current actual situation of new energy market entry, the upper limit of the proportion of new energy projects participating in mechanism electricity volume to grid-connected electricity volume is classified: centralized wind power 70%, centralized photovoltaic 40% (including 100% for poverty alleviation part), industrial and commercial distributed photovoltaic connected at 10kV and above 80%, other distributed photovoltaic and decentralized wind power 100%. For the same power station with multiple types of electricity, the highest proportion of mechanism electricity executed is weighted according to the capacity proportion of the corresponding types. New energy power generation projects can independently determine the proportion of mechanism electricity executed each year within the scale limit, but not higher than the previous year.

The mechanism electricity price is implemented according to the current coal-fired power generation benchmark price of 0.3644 yuan/kWh in Southern Hebei Power Grid. Northern Hebei Power Grid is implemented according to the current coal-fired power generation benchmark price of 0.372 yuan/kWh.

Incremental project single project declaration scale = project installed capacity × average utilization hours of similar projects in the past three years × (1 - plant self-use rate) × mechanism electricity declaration ratio.

The Provincial Development and Reform Commission comprehensively considers factors such as reasonable cost and revenue of new energy, green value, power market supply and demand situation, and user affordability, and annually determines and publishes the upper limit of bidding for incremental projects, which is temporarily not higher than the coal-fired power generation benchmark price.

The execution period for wind power and photovoltaic is tentatively set at 10 years and 12 years respectively, with subsequent adjustments based on actual market operation. Offshore wind power and offshore photovoltaic are separately organized for bidding to determine the scale of electricity included in the mechanism and the mechanism electricity price, with the execution period tentatively set at 14 years.

03 Inner Mongolia Autonomous Region Energy Bureau issued the "Eastern Inner Mongolia Power Market Rules System (Trial) (Draft for Comments)".

On September 5, the Inner Mongolia Autonomous Region Energy Bureau issued the "Eastern Inner Mongolia Power Market Rules System (Trial) (Draft for Comments)", including nine documents such as "Basic Rules for Operation of Eastern Inner Mongolia Power Market (Trial)" and "Registration Implementation Rules for Eastern Inner Mongolia Power Market (Trial)".

04 Jiangxi Provincial Development and Reform Commission issued a public solicitation of opinions on the "Implementation Plan for Market-oriented Reform of New Energy Grid-connected Electricity Prices in Jiangxi Province (Draft for Comments)" and supporting rules.

On September 8, the Jiangxi Provincial Development and Reform Commission issued a public solicitation of opinions on the "Implementation Plan for Market-oriented Reform of New Energy Grid-connected Electricity Prices in Jiangxi Province (Draft for Comments)" and supporting rules.

Promote the participation of new energy grid-connected electricity in market transactions. In principle, all grid-connected electricity from new energy projects within the province enters the electricity market, and grid-connected prices are formed through market transactions. Centralized wind and photovoltaic projects generally participate directly in market transactions through quantity and price bidding. Distributed wind and distributed photovoltaic projects are encouraged to participate in market transactions directly or aggregated through quantity and price bidding; those not directly or aggregated participating act as price takers in market transactions. New energy electricity not connected to the grid due to bidding or other factors after market participation is not included in new energy utilization rate statistics and assessments. New energy projects enjoying financial subsidies will have subsidy standards within the reasonable utilization hours of the full lifecycle executed according to original regulations.

Existing projects

Existing new energy projects put into operation before June 1, 2025, the upper limit of mechanism electricity volume shall, in principle, be connected with the current guaranteed related electricity scale policies. New energy already participating in green power transactions is not included in the mechanism electricity scope. The mechanism electricity price is uniformly implemented according to the Jiangxi coal power benchmark price (coal power benchmark price is 0.4143 yuan/kWh).

The execution period is determined according to the remaining reasonable utilization hours of the full lifecycle and the earlier of 20 years after commissioning.

The commissioned capacity of centralized new energy is based on the project approval (filing) capacity, and the commissioning time is based on the latest commissioning time of the approved (filed) generating units in the power business license; the commissioned capacity and time of distributed new energy are based on the "grid-connected capacity" and "grid-connected date" of the project in the grid company's marketing system.

Incremental projects

For incremental new energy projects put into operation on or after June 1, 2025, the annual total scale of mechanism electricity volume is determined comprehensively considering factors such as the installed capacity of incremental new energy projects in the year, reasonable utilization hours, user affordability, and the completion of non-hydropower renewable energy power consumption responsibility weights.

The mechanism electricity price is formed by competition, specifically determined according to the marginal unit bidding price, with the same mechanism electricity price level for the same batch and type of projects.

The bidding ceiling considers reasonable cost returns, green value, power market supply and demand situation, user affordability, and other factors. To avoid disorderly competition in the initial stage, bidding floor prices and minimum declaration sufficiency rates are set to guide new energy to fully compete and reduce the overall social energy cost.

The execution period is reasonably determined based on the average payback period of initial investment for similar projects, with the start time determined according to the project’s declared commissioning time, and for projects already commissioned when selected, the selection time is used.

The first bidding for incremental projects in 2025 is tentatively scheduled for October 2025, covering incremental new energy projects commissioned from June 1, 2025, to December 31, 2026.

New energy sustainable development price settlement exit mechanism. New energy projects can independently determine the proportion of electricity volume executed under the mechanism each year within the upper limit, but not higher than the previous year. New energy projects included in the mechanism may voluntarily apply for exit during the execution period. Projects that expire or voluntarily exit during the period will no longer be included in the mechanism. Grid companies should establish regular verification mechanisms and manage the exit of new energy projects upon expiration.

Improve the auxiliary service market mechanism. Optimize Jiangxi Province's auxiliary service price mechanism. Frequency regulation and reserve auxiliary service fees that meet regulations are, in principle, jointly borne by user electricity consumption and grid-connected electricity not participating in the electricity market. New energy grid-connected electricity participating in the provincial electricity market will no longer share these fees.

05 Gansu Energy Regulatory Office issued the "Gansu Province Power Auxiliary Service Market Operation Rules (Draft for Comments)"

On September 8, the Gansu Energy Regulatory Office issued the "Gansu Province Power Auxiliary Service Market Operation Rules (Draft for Comments)". The document clarifies that grid-side energy storage can participate in auxiliary service market transactions as independent entities; power-side energy storage can be regarded as integrated with generating units to participate in auxiliary service market transactions. User-side energy storage is temporarily not allowed to feed electricity back to the grid.

Grid-side energy storage charging power should be 10,000 kilowatts or above, with continuous charging for 2 hours or more, equipped with independent metering and automatic generation control (AGC) functions, and accept unified grid dispatch as independent entities to provide auxiliary services to the grid. Power-side energy storage is regarded as integrated with generating units to provide auxiliary services to the grid.

Market participants can declare frequency regulation mileage prices for 96 points daily for the coming week on the power trading platform by AGC control units (price unit: yuan/megawatt). The price ceiling is tentatively set at 15 yuan/megawatt, and the minimum price declaration unit is 0.1 yuan/megawatt.

Frequency regulation auxiliary service market compensation fees are jointly borne by electricity users' consumption, grid-side energy storage off-grid electricity, and grid-connected electricity not participating in the electricity market.

During commissioning periods, generating units and grid-side energy storage, as well as generating units (excluding coal power emergency backup power) and grid-side energy storage that have exited commercial operation but can still generate and feed into the grid, share fees not exceeding 10% of the monthly commissioning period electricity fee income. The portion exceeding 10% is shared by electricity users' consumption, grid-side energy storage off-grid electricity, grid-connected electricity not participating in the electricity market, and other new energy enterprises' grid-connected electricity included in the provincial power balance (including DC supporting new energy electricity not operated under independent control zones).

International developments

The Spanish energy storage market is experiencing a historic policy turning point. In April 2025, a nationwide blackout affecting Spain, Portugal, and surrounding countries impacted over 50 million people, exposing the grid's vulnerability to a high proportion of renewable energy. Now, new regulations in Spain's energy storage trading segment may solve project financing difficulties and accelerate the implementation of energy storage projects to address electricity shortages.

It is reported that the Spanish government has issued Royal Decree Law 7/2025, explicitly designating energy storage as a "public utility" and including it in the "emergency approval" green channel, while setting a target of 22.5 GW of energy storage capacity by 2030. Information shows that currently Spain has 14 GW of energy storage projects with grid connection permits, of which 7 GW are under approval and 17.3 GW projects are awaiting approval. If all these projects are realized, Spain's energy storage capacity will increase by 1000 times from the current 24 MW. In fact, the intraday price difference in Spain's electricity wholesale market is already considerable. For example, on August 27, 2025, the peak-valley electricity price difference reached 64.47 euros/MWh, and the average annual peak-valley price difference can be maintained in the range of 24-38 euros/MWh, creating a very attractive arbitrage space for energy storage projects. Additionally, according to the IDAE "EBAFLEX" report, deploying a total of 6.4 GW of battery storage (5 GW centralized + 1.4 GW distributed) combined with achieving 20% demand-side response can save the Spanish national power system 1.447 billion euros annually and save 375 million euros in distribution network renovation costs. The long-term power purchase agreement (PPA) model for battery storage may systematically resolve the above pain points. In countries like France, Germany, Italy, or the UK, 7-year pure battery storage PPAs have been implemented, providing industrial users with fixed electricity prices while significantly improving project financing profitability. Experts point out that the PPA model will accelerate the release of market vitality for the first batch of energy storage projects and generate revenue through ancillary service markets and peak-valley arbitrage. However, the Spanish energy storage market still faces the pain point of long approval cycles. Although project construction and installation require 4 months, obtaining administrative approval takes an average of 2 years, seriously affecting project progress.

Key words:

Previous Page:

Recommended News

Contact

Address: Chanhe Innovation Technology Park, No. 2 Zhenxing Road, Chanhe Hui District, Luoyang City, Henan Province

Tel:0379-63869669

Mailbox:info@hydromobility.cn

Scan

Copyright©2023 Qingcheng Power Technology(Luoyang) Co.,Ltd. This website supports ipv6

Copyright©2023 Qingcheng Power Technology(Luoyang) Co.,Ltd.

This website supports ipv6

豫公网安备41030402000254号

豫公网安备41030402000254号