2024 Energy Storage Industry Summary and 2025 Development Trends!

Release time:

2025-01-06

Source:

The future development of the energy storage industry is shifting from pure rapid growth to high-quality development. This transition requires not only technological innovation and the improvement of market mechanisms but also policy support and industry self-discipline to ensure the healthy, stable, and long-term development of the energy storage industry.

2024 Energy Storage Industry Summary

Goodbye 2024!

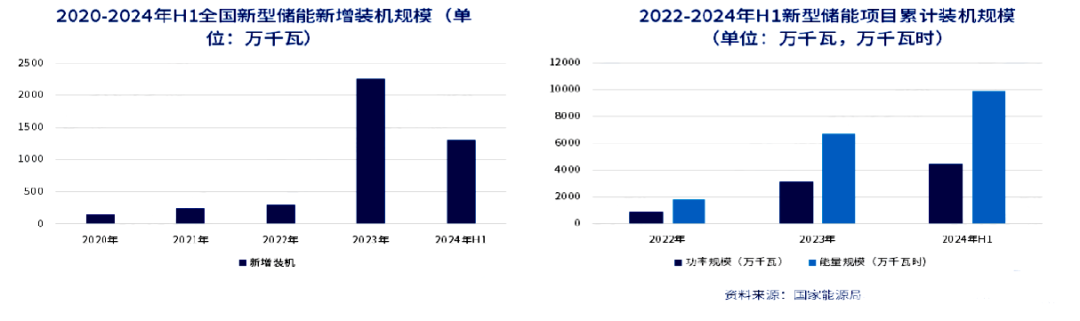

In 2023, China's new energy storage installed capacity reached approximately 22.6 million kilowatts / 48.7 million kilowatt-hours, nearly 10 times the installed capacity at the end of the 13th Five-Year Plan, demonstrating the strong development momentum of new energy storage technology. As we enter 2024, this trend continues, with new energy storage installed capacity in the first half of the year reaching 13.05 million kilowatts / 32.19 million kilowatt-hours, further consolidating its key position in energy transition!

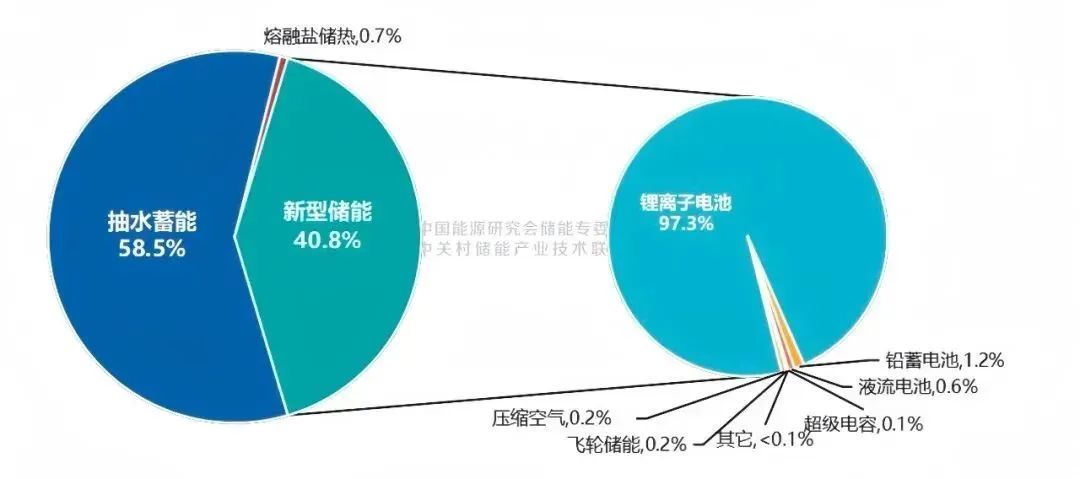

By the end of 2023, the cumulative operational power storage in the country reached 90.4 GW, a year-on-year increase of 42%; new energy storage projects grew rapidly, accounting for over 40%, with lithium batteries continuing to increase their share in new energy storage, exceeding 97%; pumped storage has dropped below 60% for the first time.

Figure 5: Distribution of cumulative installed power storage in China (as of the end of March 2024, MW%)

(Data source: CNESA)

In terms of application, China mainly focuses on large-scale storage on the source and grid side, and in the past two years, the installed capacity of user-side storage has gradually increased, with the proportion of newly operational installed capacity in the first quarter of this year breaking 10% for the first time.. Overall, China is dominated by "source-grid" side storage in the overall energy storage application direction!

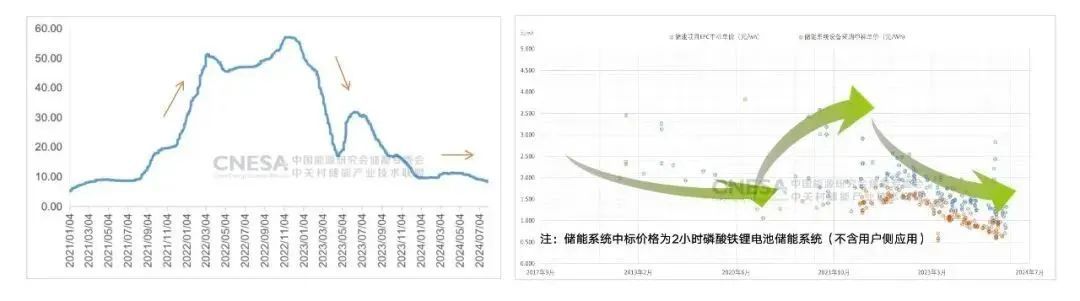

The price competition in the energy storage industry chain is fierce. Last year, the price of battery-grade lithium carbonate was in a state of rapid fluctuation, ranging from hundreds of thousands at the beginning of the year to tens of thousands at the end. In the first half of 2024, the average winning bid price for energy storage systems was 0.68 yuan/Wh, a year-on-year decrease of 49%.

Currently, the planning targets for new energy storage installations continue to rise. By the end of July 2024, 26 provinces and cities across the country have set new energy storage installation targets for 2025, with a total scale reaching 86.6 GW, far exceeding the 40 GW target set by the "2024-2025 Energy Saving and Carbon Reduction Action Plan"; more than 20 regions have proposed a 2025 output/revenue target exceeding 50 billion yuan, with a total scale target of nearly 3.4 trillion yuan.

The configuration of energy storage with renewable energy remains the core driving factor for energy storage development. So far, nearly 30 regions in the country have introduced policies regarding the configuration of energy storage for renewable energy, requiring that the proportion of energy storage configured for renewable energy projects be between 5% and 20%.

2025 Energy Storage Industry Development Trends

The future development potential of the energy storage industry is enormous, and its development is of significant strategic necessity. The judgment on the development trends of the energy storage industry in 2025 can be summarized as follows:

1. China's energy storage industry will continue to maintain an active development trend.

2. The annual growth rate of the energy storage market scale will exceed 40%, continuing to show strong growth momentum.

3. Industry competition will also become increasingly fierce, driving companies to continuously innovate and improve product quality.

4. Breakthroughs in battery technology will lead to a significant reduction in energy storage equipment costs. Companies with cost advantages will further expand their market, forming a head effect.

5. Leading domestic energy storage companies will accelerate their internationalization, actively laying out overseas markets to expand broader development space.

6. The process of market-oriented trading in energy storage will accelerate, injecting new momentum into industry development.

In summary, in the face of these trends, the future development of the energy storage industry will shift from pure rapid growth to high-quality development. This transition requires not only technological innovation and improvement of market mechanisms but also policy support and industry self-discipline to ensure the healthy, stable, and long-term development of the energy storage industry.

Key words:

Recommended News

Contact

Address: Chanhe Innovation Technology Park, No. 2 Zhenxing Road, Chanhe Hui District, Luoyang City, Henan Province

Tel:0379-63869669

Mailbox:info@hydromobility.cn

Scan

Copyright©2023 Qingcheng Power Technology(Luoyang) Co.,Ltd. This website supports ipv6

Copyright©2023 Qingcheng Power Technology(Luoyang) Co.,Ltd.

This website supports ipv6